Important Notice

By accessing this Website, you acknowledge and agree to accept the following Terms of Use pertaining to the use of the Site, which constitute a legal agreement between you and CVC.

This Website and the materials herein are intended for certain types of investors only and to persons in certain jurisdictions where the strategy is authorised for distribution.

Please choose from the following countries. By selecting a country from the list below, you certify that you are resident in that country. Should you be resident in a country that is not listed below, you cannot access the content of this Website.

Please select your investor type. By selecting an investor type from the below list, you certify that you qualify as that type of investor based on the definitions below.

A Professional investor is defined as

- any person or entity that is a credit institution, investment firm, other regulated financial institution, insurance company, collective investment scheme, pension fund or, for investors in the European Economic Area, persons or entities that qualify as a Professional Investor under AIFMD2;

- for investors in the United Kingdom, any person or entity that is a credit institution, investment firm, other regulated financial institution, insurance company, collective investment scheme, pension fund or any persons or entities that qualify as a Professional Investor under section 3.5 Conduct of Business Sourcebook of the FCA Handbook of Rules and Guidance;

- for investors in Switzerland, any persons or entities (a) who is a Professional Client as defined in article 4(3) of the Swiss Federal Act on Financial Services (FinSA) or (b) a Private Client within the meaning of article 4(2) FinSA who is in a long-standing investment advisory- or investment management relationship with a regulated financial intermediary and who did not declare that they shall not be treated as qualified investors in accordance with article 10 (3ter) of the Swiss Federal Act on Collective Investment Schemes

Past performance does not predict future returns. There can be no assurance the Fund will achieve its objectives or avoid significant losses.

This page and the content of this website is not an offer to sell the Fund’s securities and is not soliciting an offer to buy the Fund’s securities in any state where the offer or sale is not permitted.

Investment is only available in Germany to Non-Professional Investors that qualify as German semi-professional investors.

German semi-professional investor” shall mean:

(1) any investor:

a) who commits to invest a minimum of EUR 200,000;

b) who states in a written document separate from the agreement on the investment commitment that it is aware of the risks associated with the intended commitment or investment;

c) whose level of expertise, experience and knowledge has been assessed by the AIFM or the distributor engaged by it without assuming that the investor has the market expertise and experience of an investor as defined in Annex II Section 1 of Directive 2014/65/EU of May 15, 2014 on Markets and Financial Instruments;

d) who has sufficiently convinced the AIFM or the distributor engaged by it that, having regard to the type of commitment or investment planned, they are in the position to make their own investment decisions and understand the risks associated with any such investment, and that any such commitment is reasonable for the investor in question; and

e) who receive written confirmation from the AIFM or the distributor engaged by it that it has performed the assessment described under c) above and that the requirements set out under d) have been met;

2) any manager or employee of the AIFM as specified in section 37 paragraph 1 KAGB (as defined below), provided they invest in an AIF managed by the AIFM, or any member of management or the management board of an externally managed investment company, provided he/she invests in the externally managed investment company;

3) any investor who commits to invest at least EUR 10 million in any investment fund;

4) any investor in the legal form of:

a) a public law institution (Anstalt des öffentlichen Rechts);

b) a public law foundation (Stiftung des öffentlichen Rechts); or

c) a company, of which the majority of interests/shares is held by the Federal Republic of Germany or a Federal State (Bundesland),

provided that at the time of the investment of such public-law institution, public-law foundation or company as described above the Federal Public of Germany or a Federal State (Bundesland) also invests in the Fund or is already invested in the Fund.

Informationen ausschließlich für professionelle und semi-professionelle Anleger

Sämtliche Informationen auf dieser Webseite insbesondere in Bezug auf den dargestellten Fonds, richtet sich in Deutschland ausschließlich an professionelle und semi-professionelle Anleger:

Professioneller Anleger

- § 1 Abs. 19 Ziffer 32 KAGB Professioneller Anleger ist jeder Anleger, der im Sinne von Anhang II der Richtlinie 2014/65/EU als professioneller Kunde angesehen wird oder auf Antrag als ein professioneller Kunde behandelt werden kann.

Semi-professioneller Anleger

- § 1 Abs. 19 Ziffer 33 KAGB

Semiprofessioneller Anleger ist, insbesondere

- a) jeder Anleger,

- aa) der sich verpflichtet, mindestens 200 000 Euro zu investieren,

- bb) der schriftlich in einem vom Vertrag über die Investitionsverpflichtung getrennten Dokument angibt, dass er sich der Risiken im Zusammenhang mit de bereabsichtigten Verpflichtung oder Investition bewusst ist,

- cc) dessen Sachverstand, Erfahrungen und Kenntnisse die AIF-Verwaltungsgesellschaft oder die von ihr beauftragte Vertriebsgesellschaft bewertet, ohne von der Annahme auszugehen, dass der Anleger über die Marktkenntnisse und -erfahrungen der in Anhang II Abschnitt I der Richtlinie 2014/65/EU genannten Anleger verfügt,

- dd) bei dem die AIF-Verwaltungsgesellschaft oder die von ihr beauftragte Vertriebsgesellschaft unter Berücksichtigung der Art der beabsichtigten Verpflichtung oder Investition hinreichend davon überzeugt ist, dass er in der Lage ist, seine Anlageentscheidungen selbst zu treffen und die damit einhergehenden Risiken versteht und dass eine solche Verpflichtung für den betreffenden Anleger angemessen ist, und

- ee) dem die AIF-Verwaltungsgesellschaft oder die von ihr beauftragte Vertriebsgesellschaft schriftlich bestätigt, dass sie die unter Doppelbuchstabe cc genannte Bewertung vorgenommen hat und die unter Doppelbuchstabe dd genannten Voraussetzungen gegeben sind,

- b) ein in § 37 Absatz 1 KAGB genannter Geschäftsleiter oder Mitarbeiter der AIF-Verwaltungsgesellschaft, sofern er in von der AIF-Verwaltungsgesellschaft verwaltete AIF investiert, oder ein Mitglied der Geschäftsführung oder des Vorstands einer extern verwalteten Investmentgesellschaft, sofern es in die extern verwaltete Investmentgesellschaft investiert,

- c) jeder Anleger, der sich verpflichtet, mindestens 10 Millionen Euro in ein Investmentvermögen zu investieren.

Jeder Interessent ist verpflichtet, vor Nutzung dieser Webseite seinen Status als professioneller oder semi-professioneller Anleger gegenüber der AIF-Verwaltungsgesellschaft, bzw. der von ihr beauftragten Vertriebsgesellschaft zu bestätigen. Interessenten, die nicht professionelle oder semi-professionelle Anleger sind, dürfen nicht auf die Webseite zugreifen. Inhalte oder Informationen aus dieser Webseite dürfen nicht an Privatanleger weitergeben oder ihnen zugänglich gemacht werden.

Investment is only available in Singapore to Accredited Investors and Institutional Investors.

The category of persons which the Monetary Authority of Singapore (the “MAS”) has prescribed as falling within the definition of “accredited investor” under the SFA is as follows:

(a) an individual whose net personal assets exceed in value two million Singapore Dollars (S$2,000,000) (or its equivalent in value in foreign currency), and in determining the value of such net personal assets for the purposes of this sub-paragraph (a), the value of the primary residence:

(i) has been calculated by deducting any outstanding amounts in respect of any credit facility that is secured by the residence from the estimated fair market value of the residence; and

(ii) has been taken to be the lower of:

(1) the value calculated under sub-paragraph (a)(i) above; and

(2) one million Singapore Dollars (S$1,000,000).

(i) are accredited investors within the meaning set out in any of paragraphs (a) through (h) above;

(ii) have reserved to themselves all powers of investment and asset management functions under the trust; and

(iii) have reserved to themselves the power to revoke the trust.

(l) The category of persons which the MAS has prescribed as falling within the definition of “institutional investor” under the SFA is as follows:

(ii) to manage the funds of the central government of that country (which may include the reserves of that central government and any pension or provident fund of that country); or

(iii) to manage the funds (which may include the reserves of that central government and any pension or provident fund of that country) of another entity that is wholly and beneficially owned, whether directly or indirectly, by the central government of that country.

(ii) whose funds are managed by an entity mentioned in paragraph (c) above.

a finance company that is licensed under the Finance Companies Act 1967 of Singapore (the “FCA”).

a company or co-operative society that is licensed under the Insurance Act 1966 of Singapore (the “Insurance Act”) to carry on insurance business in Singapore.

a company licensed under the Trust Companies Act 2005 of Singapore (the “TCA”).

a designated market-maker (as defined in the Second Schedule to the Securities and Futures (Licensing and Conduct of Business) Regulations of Singapore (the “SFLCB Regulations”)).

Investment is only available in Switzerland to Regulated Qualified Investors and Qualified Investors.

A “Regulated Qualified Investor”is one of the following:

(d) a national or supranational public entity with professional treasury operations;1

A “Qualified Investor” (as defined in CISA (where applicable, in connection with Articles 4 and 5 of FinSA)), is one of the following:

1. A company has professional treasury operations where it entrusts, on a permanent basis, the management of its funds to a professionally qualified person with experience in the financial sector.

2. A private investment structure has professional treasury operations where it entrusts, on a permanent basis, the management of its funds to a professionally qualified person with experience in the financial sector.

3. This means that the relevant individual must: i) hold assets of at least CHF 500,000 and have sufficient professional knowledge or experience to understand the risks related to an investment in the Fund; or ii) hold bankable assets of at least CHF 2,000,000.

Investment is only available in the UK to Non-Professional Investors that qualify as Exempt retail investors.

“Exempt retail investor” shall mean:

(a) An “investment professional” within the meaning of Article 14(5) of the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 (as amended) (the “CIS Promotion Order”) or Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion Order) 2005 (the “Financial Promotion Order”), as applicable, by falling into one of the following categories (please check the category which applies):

(g) A Person to whom the Fund Documents may otherwise lawfully be made available in accordance with the Financial Services and Markets Act 2000 and the CIS Promotion Order, Section 4.12B of the Conduct of Business Sourcebook of the FCA Rules or the Financial Promotion Order, as applicable.

Eligibility Confirmation

The information on this Website is only intended for investors who meet the specified eligibility criteria.

CVC does not provide investment advice. You should consult an authorised person specialising in advising on investments prior to making any investment.

Do not invest unless you are prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong.

Important Information

You must read the following information before proceeding to the Website. The following important information, together with the information available at the Terms of use and Privacy Policy governs your use of this Website. Your use of this Website and the materials herein constitutes your acceptance of these terms of use. If you do not agree with the terms of use, you should immediately cease use of the Website and review of the materials.

This Website is a marketing communication. The prospectus and the Key information document (KID) contain information about the Fund. All investors are urged to carefully read the prospectus and KID in their entirety before making an investment decision.

No Offer of Securities or Investment Advice: This Site and the materials herein are presented for informational purposes only. Neither the Site nor the materials herein constitutes a solicitation or offer by CVC to buy or sell any securities of any kind or provide any investment advice or service. This Site does not provide specific investment advice to any individual viewing the content of the Site and does not represent that the securities or services described herein are suitable for any specific investor.

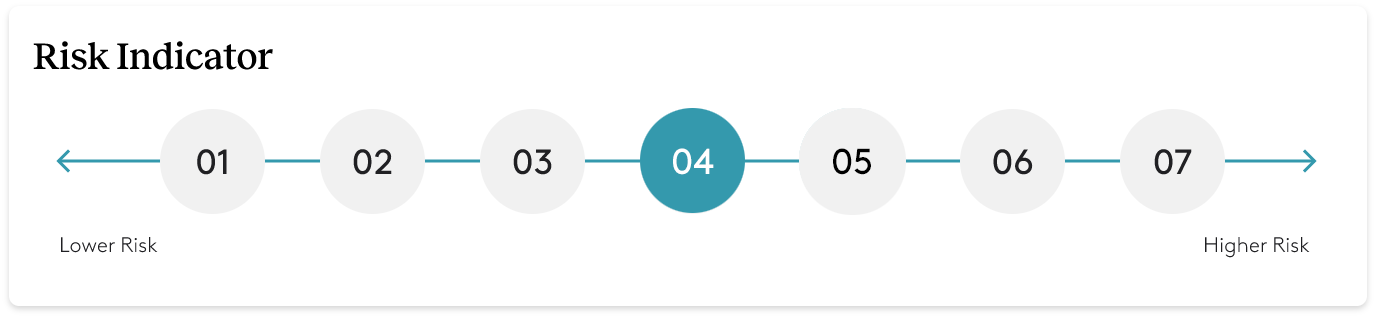

Risks Associated with Investing: Please refer to the Risk Summary set out below.

Past performance does not predict future returns. There can be no assurance the Fund will achieve its objectives or avoid significant losses.

Certain information on this Site has been obtained from sources that CVC believes to be reliable as of the date presented; however, CVC cannot guarantee the accuracy of such content, assure its completeness, or warrant that such information will not be changed. In particular, (i) pricing information is estimated and unaudited and (ii) commentary on specific securities, if any, reflects the author’s analysis. The information on this Site is current as of the publication date indicated. CVC is under no obligation to update the information to reflect changes after the publication date.

The information contained herein may not be reproduced or otherwise disseminated in whole or in part without the prior written consent of CVC.

By clicking the below checkbox, I confirm that the information provided on the prior page and above relating to my investor type and country of residence is accurate, and I accept and acknowledge the important information above, together with the information available at the Terms of use and Privacy Policy of this Website.

Lack of Liquidity.

There is no current public trading market for the shares in the Fund, and CVC does not expect that such a market will ever develop. Therefore, redemption of shares in the Fund will likely be the only way for an investor to dispose of its shares. The Fund generally expects to redeem shares at a price equal to the applicable net asset value as of the redemption date and not based on the price at which the investor initially purchased its shares. Subject to limited exceptions, shares redeemed within one year of the date of issuance will be redeemed at 98% of the applicable net asset value as of the redemption date. As a result, an investor may receive less than the price that it paid for its shares when it redeems them. The aggregate net asset value of total redemptions is generally limited to 5% of such aggregate net asset value per calendar quarter based upon the average aggregate net asset value as of the last business day of each of the immediately preceding three calendar months or the aggregate number of shares outstanding as of the last business day of the immediately preceding calendar quarter. The Fund may make exceptions to, modify or suspend, in whole or in part, the redemption program in certain circumstances. Should the Fund be required to satisfy significant redemption requests in a short period of time, the Fund could, notwithstanding the application of the “redemption gates”, be forced to liquidate investments prematurely, causing losses to the Fund. The calculation and payment of an investor’s redemption proceeds may be based on estimated and unaudited data. Accordingly, adjustments and revisions may be made to the net asset of the Fund following the year end audit of the Fund or at such other times as is required by law or regulation. However, once paid, no revision to an investor’s redemption proceeds is generally expected to be made based upon audit adjustments.

Risk of Capital Loss and No Assurance of Investment Return.

This investment is speculative and long term with no certainty of return. This investment involves a significant risk of capital loss and should only be made if an investor can afford the loss of its entire investment.

Limited Operating History: Relation to Prior Investment Results.

The Fund has not commenced operations and therefore has no operating history upon which prospective investors may evaluate its performance. As a result of the Fund’s highly customized investment program and investment limitations, there is no assurance that the Fund will receive sufficient investment opportunities to deploy all of its capital, even in a circumstance where other funds or accounts managed or advised by CVC are fully or nearly fully deployed.

Difficulty and Cost of Locating Suitable Investments.

There is no guarantee that suitable deal flow will be available so that the Fund will be able to invest in investments or that any such investments will be successful. No assurances can therefore be given that the target returns of the Fund or any investment will be achieved.

Investment and Market Risk.

Changing economic, political, regulatory or market conditions or events, such as interest rates, the availability of credit, currency exchange rates, trade barriers, natural disasters, epidemics and pandemics, globally and in the jurisdictions and sectors in which the Fund invests or operates, general levels of economic activity, the price of securities and debt instruments and participation by other investors in the financial markets, may affect the availability of investment opportunities for the Fund and/or the value and number of investments made by the Fund or considered for prospective investment.

Legal, Tax and Regulatory Risks.

Legal, tax and regulatory changes could occur during the term of the Fund that may adversely affect the Fund. The regulatory environment for private investment funds is evolving, and changes in the regulation of private investment funds (including alternative investment funds) may adversely affect the value of investments held by the Fund and the ability of the Fund to effectively employ its investment and trading strategies.

Broad Investment Mandate.

Except as set forth in the governing documentation of the Fund, the Fund shall not be limited or restricted in the industries, sectors, geographies, transaction types, structures, instruments, obligations or assets in which it may invest or the specific investment strategies and techniques that may be employed by it. Its portfolio may be concentrated at various points in time, including, for example, with respect to the number of investments included in the portfolio (which may be particularly limited when it commences its investing activities), the nature of such investments and the geographies or industry sectors represented by the issuers in which the Fund invests.

Credit Risk.

One of the fundamental risks associated with the investments is credit risk, which is the risk that a borrower will be unable to make principal and interest payments on its outstanding debt obligations when due or otherwise defaults on its obligations to the Fund and/or that the guarantors or other sources of credit support for such persons do not satisfy their obligations. The Fund’s returns to investors would be adversely impacted in such event.

Sub investment Grade and Unrated Debt Obligations Risk.

The Fund’s investment strategy is focused on investing in sub investment grade debt obligations. The Fund may invest in other circumstances on an opportunistic basis. Investments in the sub investment grade categories are subject to greater risk of loss of principal and interest than higher rated instruments and may be considered to be predominantly speculative with respect to the obligor’s capacity to pay interest and repay principal. In addition, the Fund may invest in investments which constitute obligations which may be unrated by a recognized credit rating agency, which may be subject to greater risk of loss of principal and interest than higher rated debt obligations or debt obligations which rank behind other outstanding instruments and obligations of the obligor, all or a significant portion of which, may be secured on substantially all of that obligor’s assets. The Fund may also invest in investments which are not protected by financial covenants or limitations on additional indebtedness.

Leveraged Loans.

The investments may include leveraged loans, which have significant liquidity and market value risks since they are not generally traded on organized exchange markets but are traded by banks and other institutional investors engaged in loan syndications. Because loans are privately syndicated and loan agreements are privately negotiated and customized, loans are not purchased or sold as easily as publicly traded securities. There can be no assurance as to the levels of defaults and/or recoveries that may be experienced on leveraged loans, and an increase in default levels could have a material adverse effect on the Fund.

Non-Controlling Investments and/or Investments with Third Parties in Joint Ventures and Other Entities.

It is expected that the Fund will hold non controlling interests in most issuers and, therefore, may have no right to appoint a director and to influence such companies’ management. Similarly, the Fund may co invest with third parties through joint ventures, other entities or similar arrangements, thereby acquiring non controlling interests in certain investments. In such cases, the Fund will be significantly reliant on the existing management, board of directors and other shareholders of such companies, which may include representation of other financial investors with whom the Fund is not affiliated and whose interests may conflict with the interests of the Fund.

Use of Borrowings/Leverage.

The Fund intends to employ leverage in order to increase investment exposure with a view to achieving its target return. Such leverage will increase the exposure of an investment to adverse economic factors such as rising interest rates, downturns in the economy or deteriorations in the condition of the investment. Borrowings by the Fund (or by an affiliate thereof) have the potential to enhance the Fund’s returns, however, they will further diminish returns (or increase losses on capital) to the extent overall returns are less than the Fund’s cost of funds. As a general matter, the presence of leverage can accelerate losses. There can be no assurance that the Fund will have sufficient cash flow to meet its debt service obligations. As a result, the Fund’s exposure to foreclosure and other losses may be increased due to the illiquidity of its investments. In addition, the Fund may need to refinance its outstanding debt as it matures and financing obtained at the time of investment may not be available for the life of the asset, on favorable terms or at all.

Reliance on Key Management Personnel.

The success of the Fund will depend, in large part, upon the skill and expertise of certain CVC professionals. In the event of the death, disability or departure of any key CVC professionals, the business and the performance of the Fund may be therefore adversely affected. Some CVC professionals may have other responsibilities, including senior management responsibilities, throughout CVC and, therefore, conflicts are expected to arise in the allocation of such personnel’s time (including as a result of such personnel deriving financial benefit from these other activities, including fees and performance based compensation).

Investors Have No Management Rights.

Investors in the Fund will have no control over the Fund’s or any Fund’s day to day operations and investment decisions, and the investors of such Fund must rely on the Fund and/or, to the extent appropriate, CVC and its agents to conduct and manage the affairs of such Fund.

Currency and Exchange Rate Risk.

A substantial portion of the Fund’s assets may be denominated in a currency that differs from the functional currency of the Fund or an investor’s functional currency. Consequently, the return realized on any investment by such investor may be adversely affected by movements in currency exchange rates over the holding period of such investment and the life of the Fund generally, costs of conversion and exchange control regulations, in addition to the performance of the investment itself. Additionally, costs related to currency hedging arrangements will be borne by the Fund. There can be no assurance that adequate hedging arrangements will be available on an economically viable basis.

No Consideration of Environmental or Social Factors.

CVC is not generally expected to subordinate the Fund’s investment returns or increase the Fund’s investment risks as a result of (or in connection with) the consideration of any environmental or social factors.

Warehoused Investments.

All decisions to make any investments in investments that have been warehoused by members of CVC and/or funds or accounts managed or advised by CVC and/or to make investments acquired with CVC seed capital will be in the discretion of CVC, and shareholders will not have an opportunity to evaluate or approve such investments or their terms.

Performance Based Compensation.

The existence of the performance fees and management fees may create a potential incentive for the Fund to make more speculative investments than it would otherwise make in the absence of such compensation arrangements, although the intended investment by CVC and its professionals in the Fund should tend to reduce this incentive. In addition, the fact that the management fee is calculated based on the net asset value of the Fund, rather than subscription amounts, may create a potential incentive for the Fund to seek to deploy the investments in investments at an accelerated pace, and/or hold investments longer than would otherwise be the case. The management fee calculations may create incentives for the Fund to incur additional borrowings or guarantees.

Risk of Certain Events Related to CVC.

A bankruptcy, change of control, restructuring or other significant event relating to CVC could cause CVC and/or the Fund to have difficulty retaining personnel or may otherwise adversely affect the CVC and/or the Fund and the Fund’s ability to achieve its investment objective.

CVC Investment.

CVC may make all or substantially all of its seed investment through the Fund and conflicts of interest may arise in respect of how the Fund is managed by CVC as a result. CVC will determine, in its discretion but subject to any express limitations thereon in governing documents of the Fund, when to cause a Fund to use the subscription amounts of other investors to redeem CVC’s seed investment, which will affect the amount that will be paid to CVC upon such redemption.

Global Distributor.

The Fund has appointed a global distributor in respect of the offering of the shares in the Fund. The global distributor is not a CVC affiliate, and its actions and performance of its contractually obligations with respect to the Fund and the offering are not wholly within CVC’s or the Fund’s control. Any failure by the global distributor to build and maintain a network of licensed securities broker dealers and other agents and/or any failure by the global distributor or such broker dealers and other agents to allocate sufficient time and expertise to the offering could have a material adverse effect on the Fund’s offering, and therefore on the Fund’s ability to raise capital and implement its investment strategy.

Conflicts of Interest; Allocation of Investment Opportunities.

The Fund is subject to certain conflicts of interest arising out of its relationships, including as a result of the fact that CVC provides investment management, advisory and sub advisory services to the Fund as well as other funds, vehicles and separately managed accounts. There is no guarantee that the applicable policies and/or agreements can adequately address or mitigate these conflicts of interest, or that CVC will identify or resolve all conflicts of interest in a manner that is favorable to the Fund. Please refer to the Issuing Document for further information with respect to the relevant risks of investing in the Fund.

No Access

The information included in this website is restricted due to applicable laws in your country of residence. The information in this website is, therefore, not available to persons located in your country of residence and/or to all categories of investors. You should seek independent financial advice before accessing this website.